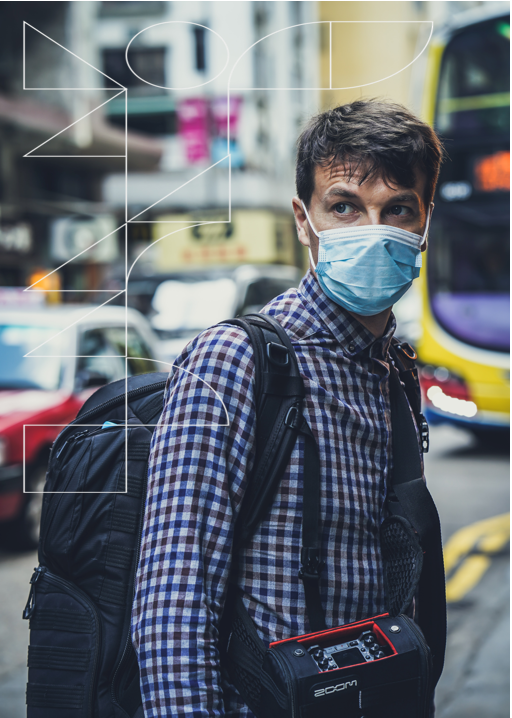

This Budget was dominated by Covid-19 as the Chancellor announced several measures to help businesses cope with the challenges presented by the new virus.

The first was to make statutory sick pay (SSP) available for employees who are self-isolating from day one of their absence from work. Currently there is no requirement for employers to pay SSP for the first three days of absence and it is only payable for periods of sickness lasting four days or more.

Emergency legislation will make SSP payable to employees who are advised to self-isolate at home and those caring for others who have self-isolated. The employee will be able to obtain a fit note from NHS111 online or by phone so will not have to visit their GP to obtain proof for the SSP payment.

Employers currently foot the bill for all sick pay whether under a voluntary company scheme or SSP. As a temporary measure the government will reimburse the costs of SSP paid for up to 14 days per employee if the absence from work is due to the coronavirus and not for any other reason.

However this reimbursement can only be claimed by employers who had fewer than 250 employees on 28 February 2020.

This article is written for the general interest of our clients and is not a substitute for consulting the relevant legislation or taking professional advice. The authors and the firm cannot accept any responsibility for loss arising from any person acting or refraining from acting on the basis of the material included herein.